Platinum Testing Downtrend Line With Potential Upside Breakout?

Platinum has underperformed gold since the ratio double bottomed in 2014. This has been especially frustrating for bulls as platinum’s cousin in the PGM group – palladium – has burst to all-time highs through the same period.

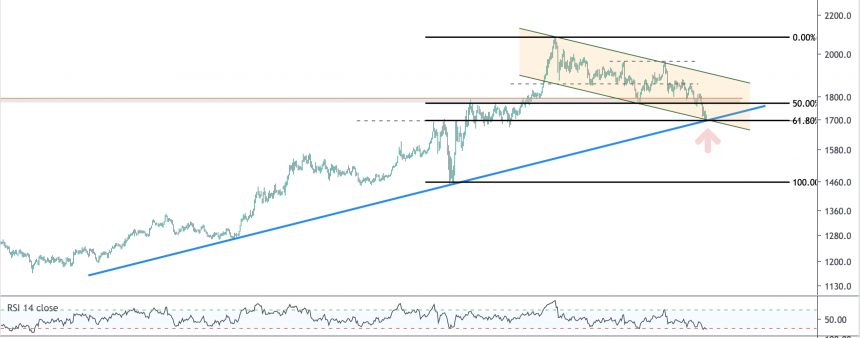

Now, following gold’s breakout in May, and silver’s breakout in the last couple of weeks, platinum finally appears to be joining the party. The weekly chart above of the gold:platinum ratio appears to be a false breakout at the 2.618 Fibonacci extension from the 2014 lows. The RSI is also diverging from the recent peak. The weekly close here will be key.

The weekly chart of platinum in dollar terms is also at a key level, looking to break out from the downtrend line started in 2013. Platinum has made two higher pivot highs and two higher pivot lows since the beginning of 2018, which is setting up for a potential breakout here.

If we zoom into the daily chart, the area of congestion I’m monitoring is ~$915 level. A break above horizontal resistance and the adjacent downtrend line would likely signal a swift move to $1030, followed by $1150.