Dollar Movement Will be Key in 2020

Energy

Precious Metals

Currencies

Fixed Income

Equities

Price Prepping for New 7-Yr Highs?

Happy New Year! We are kicking off the New Year with stocks at all-time highs, oil prices spiking on Middle East tensions, and the precious metals complex following through nicely for our November/December videos. If you haven’t had a chance to watch those videos, they offer a helpful background on the technical setup for metals and the price action we are seeing today.

Gold, Silver, Platinum, Palladium, and Copper

In this week’s video I take a look at the charts of gold, silver, platinum, palladium, and copper and offer some thoughts on where I see prices moving next. In the case of gold, which has enjoyed a fantastic run-up from $1180 to $1570 this year (in the process breaking out of a six year base), price is pulling back and bull flagging at the 61.8% Fibonacci retracement. Does it make a push down to $1400 to backtest the entire move? Will silver find support at $16.60 or are we moving lower? Will palladium continue its historic march hire, or will it meet resistance at future levels?

I discuss all this and more in today’s ten minute video. As always, whether you agree or disagree with my analysis, I would love to hear your feedback.

Gold Entering Seasonally Strong Period At 6-Year Highs

Gold Entering Seasonally Strong Period At 6-Year Highs

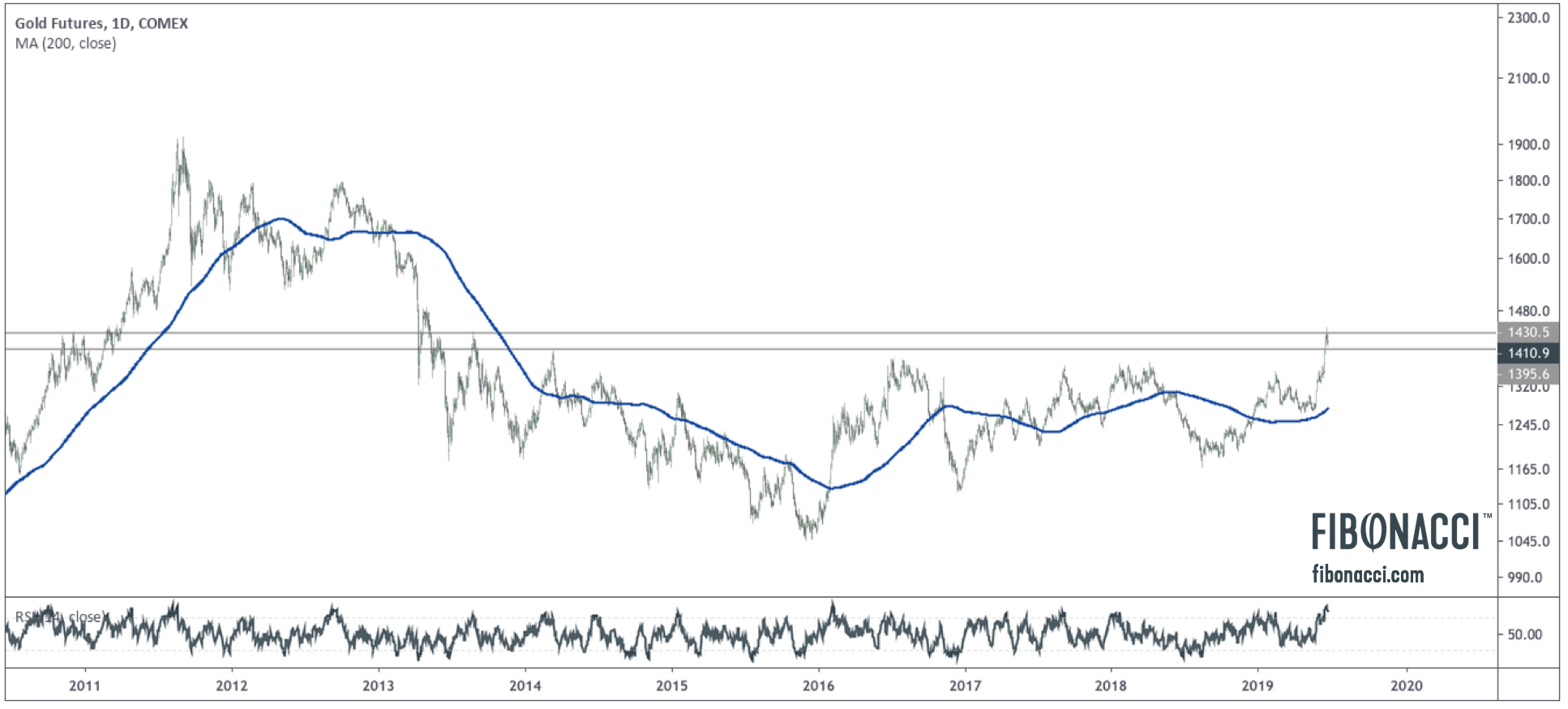

The gold price close will be significant today, as gold will print end of day, end of week, end of month, and end of quarter closing prices. Gold bulls really want to see a close above $1400 (the 2014 peak). If gold holds here, the next target is a weekly close above $1435 (the high from the 2013 dead cat bounce), which should drive further buying activity into the gold market. A strong close today will be significant. (more…)

Gold Bugs Return from Exile

The long suffering (and diminishing) army of gold bugs, distraught over gold’s underperformance in the wake of asset inflation, government spending, and historically low (sometimes negative) interest rates over the last seven years, received a resounding message of hope yesterday when gold broke through long term resistance to top tick at 1397.70. Silver also broke through near term resistance of $15.15, and this morning gold miners also jumped higher and confirmed the breakout and retest of the long term down trend line from the 2011 highs. It all seems to be working at the moment for the precious metals sector. Let’s look at the charts. (more…)

Testing Resistance

The palladium price broke up from its first test of resistance (blue trend line) and is now in the process of testing its second resistance line (red trend line). This action comes on the heels of a successful test of the 61.8% Fibonacci retracement from the August lows to the March peak, as shown in the chart below. (more…)

Gold looks bullish; Platinum, not so much

Here is a quick snapshot of the metals sector. The silver chart above is constructive, as silver broke out of a falling wedge and confirmed the bullish action in gold. It also successfully hit its initial target of $15.15-$15.20. The support levels to watch now are $14.30-$14.50, where silver may retest falling wedge support (formerly resistance) and the trend line from the August lows. A break above $15.20 should target a move to $16.20. (more…)