Test of 30-year highs rejected this week

After a quick mid-summer vacation I am finally getting back into the swing of things here. I’d like to kick off a few posts this week by highlighting the move in silver and specifically the gold/silver ratio.

As we have discussed at length in previous posts, the story this summer has been gold breaking out of a six-year base at $1365 and finally showing signs of strength after may false starts. What has made many gold bulls lingering skeptics has been the performance of silver, which is a smaller market with higher beta. Generally, when gold goes up, silver goes up much faster. When gold goes down, silver goes down much faster. (more…)

Gold Entering Seasonally Strong Period At 6-Year Highs

Gold Entering Seasonally Strong Period At 6-Year Highs

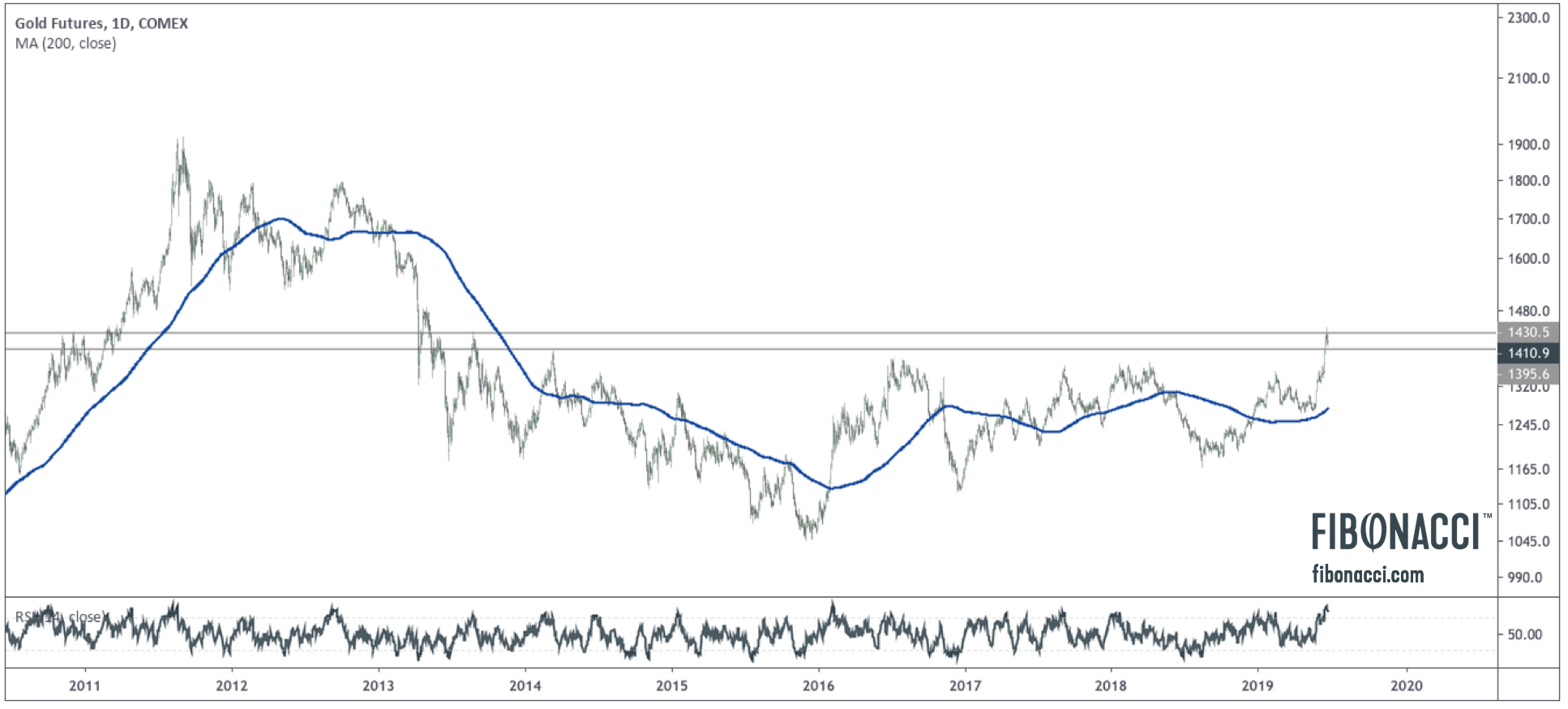

The gold price close will be significant today, as gold will print end of day, end of week, end of month, and end of quarter closing prices. Gold bulls really want to see a close above $1400 (the 2014 peak). If gold holds here, the next target is a weekly close above $1435 (the high from the 2013 dead cat bounce), which should drive further buying activity into the gold market. A strong close today will be significant. (more…)

Gold Bugs Return from Exile

The long suffering (and diminishing) army of gold bugs, distraught over gold’s underperformance in the wake of asset inflation, government spending, and historically low (sometimes negative) interest rates over the last seven years, received a resounding message of hope yesterday when gold broke through long term resistance to top tick at 1397.70. Silver also broke through near term resistance of $15.15, and this morning gold miners also jumped higher and confirmed the breakout and retest of the long term down trend line from the 2011 highs. It all seems to be working at the moment for the precious metals sector. Let’s look at the charts. (more…)

Gold looks bullish; Platinum, not so much

Here is a quick snapshot of the metals sector. The silver chart above is constructive, as silver broke out of a falling wedge and confirmed the bullish action in gold. It also successfully hit its initial target of $15.15-$15.20. The support levels to watch now are $14.30-$14.50, where silver may retest falling wedge support (formerly resistance) and the trend line from the August lows. A break above $15.20 should target a move to $16.20. (more…)

The precious metals sector has continued the momentum it closed with in May. Gold and silver, in particular have been surging this first trading day in June. Let’s take a look at the technicals.

Gold has moved from a bottom at 1167 last July to a peak at 1350 in February. Beginning in February, volatility began narrowing and gold has been mired in a falling wedge pattern. According to Bulkowski (2010), 92% of falling wedge patterns break to the upside, and of those that break, 90% reach the upside target which is measured as the distance from the breakout move to peak, added to the recent breakout. I see the original break as $1238, so in this case, that would set an upside objective at $1400-$1420. (more…)