Flight to safety

Since 2015, the gold market and bond market (I use the $TLT 20-Year Bond ETF as a proxy for bond market performance) has been highly correlated. Both asset classes are viewed as a risk-off flight to safety. While past performance does not predict future performance, it is worth noting that many are viewing the bond market as a “bubble,” while simultaneously extolling the opinion that gold has entered a long-term secular bull market. I am personally allowing for the possibility that both have much higher long term upside, particularly when considering that US bonds offer the highest yields in the world. The best yielding sovereign bonds should continue to fetch a global bid.

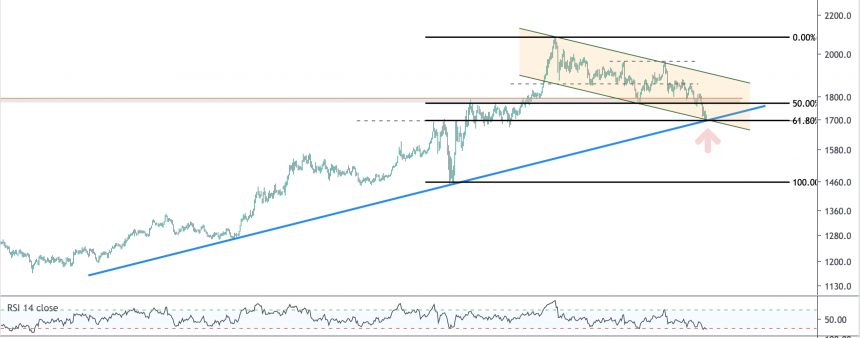

As for gold, it should continue to benefit from a negative interest rate environment. Nearly 25% of the global bond market trade at negative yields. The knock on gold has always been that it has a negative carry cost (storage fees, insurance, etc) while offering no yield or dividend. In a negative rate environment, those criticisms are neutralized, and gold becomes an increasingly attractive hedge.

While in the short term both assets are ripe for a pullback, I expect the long term trend to persist.