Written by Adem Tumerkan at Palisade-Research.com April 25, 2018

Commodities and gold are finally getting the attention they deserve.

Many of us contrarians and independent-thinking investors are fond of commodities in a portfolio – especially the commodity producers – in today’s market.

High-quality junior mining equities are just so cheap compared to the major markets like the S&P 500.

The type of optionality and leverage offered from commodity producers today makes for an excellent addition in a portfolio.

For instance – if the price of physical gold increases 10%, a quality gold mining equity can increase 100%. . .

Many of our readers know my love for gold miners and their options used as a ‘tailhedging’ strategy. This means putting a small percentage of your capital in mining stocks to capture the huge gains they offer once gold prices increase.

Well, it’s starting to look like the mainstream investors and big banks are catching on to this ‘long gold and commodities’ strategy also.

A few days ago, famed investor and CEO of Doubleline Capital – Jeff Gundlach – said he’s very bullish on gold.

He’s known as the ‘Bond King’ – and when someone hailed as a bond king turns bullish on gold, that’s a serious sign. . .

“We see a massive base building in gold. Massive. It’s a four-year, five-year base in gold. If we break above this resistance line, one can expect gold to go up by, like, a $1,000. . .”

Just like I’ve talked about previously, the big upside for gold is the U.S. Dollar weakening. And that’s exactly what Jeff Gundlach believes will send gold up by “like, a $1000.”

The U.S. Dollar has a lot of negative asymmetry (big downside risk – little reward) in the foreseeable future.

“When you get a lousy year in the dollar, like last year, it’s very typically followed up by another year that’s bad just after,” Gundlach said.

Here are just a few of the big reasons:

Massive trade deficits – caused by Trump’s tax cuts and huge spending plans. . .

Flattening yield curve that’s heading towards inversion – a classic recession indicator. . .

And most importantly – the ramping up trade war with China that leaves us vulnerable to their ‘nuclear option’ of dumping $1.3 trillion in U.S. bonds.

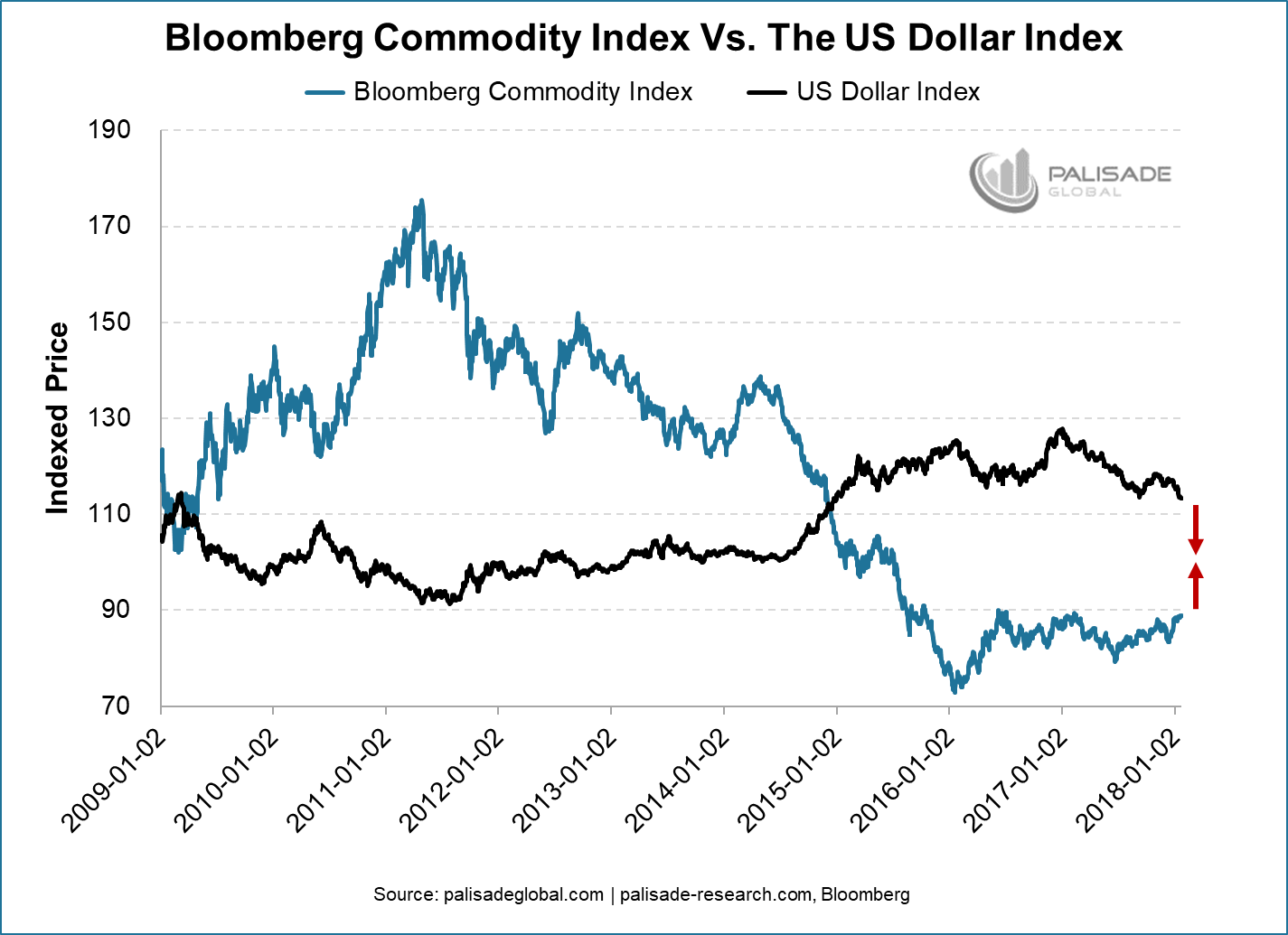

The investment thesis is clear – the further the U.S. Dollar falls, the higher gold and commodities will climb.

That’s why Jeff Gundlach is so bullish on gold – he understands the dollars bleak outlook.

Another big name that’s finally agreeing with this outcome is Goldman Sachs.

According to them, the case for owning commodities has “rarely” been stronger. . .

“With raw materials rallying on escalating political tensions across the globe and economic growth remaining strong, the bank’s analysts including Jeffrey Currie doubled down on their “overweight” recommendation. They reiterated a view that commodities will yield returns of 10 percent over the next 12 months, according to an April 12 note. . .”

One of the best sayings for investors in my opinion – Thanks to Jim Grant – is that to make out-sized returns, you want the crowd to agree with you –later.

You want to be in the assets long before everyone else is; while it’s cheap.

As a recent example – think about the investors who hoarded bitcoin a year or so before it sky-rocketed.

I will say it again – as I have for a long time – that the U.S. Dollar has more downside ahead, while gold has much more upside.

Jeff Gundlach and Goldman Sachs finally agreed with this – and many more will.

Sooner, rather than later.